INTRODUCTION

The Ghana Revenue Authority (GRA) is the main institution responsible for administering taxes, ensuring compliance, and collecting revenue to fund national development in Ghana. Its operations cover the following areas:

Governance and Structure

Board of Directors: | Commissioners

Oversees GRA’s operations, ensuring compliance with government policies.

Mr. Edward Apenteng Gyamerah | 2019-Present

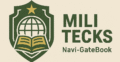

Brigadier General Zibrim Ayorrogo | 2024-Present

Pearl Nana Ama Darko | 2024-Present

Commissioner-General:

Heads the authority and supervises all divisions and units.

Ms. Julie Essiam | 2024-present

- Departments and offices under the Commissioner General include:

- Board Secretariat and Management

- Internal Audit

- Legal Affairs, Treaties, Debt Mgt. and Enforcement

- Strategy, Research, Policy, and Programs

- Objections and Dispute Resolution

- Risk Management

- Ethics and Good Governance, which will cover Intelligence, Investigation, Internal Affairs, and Anti-Money Laundering.

- Customer Care, Communications and Public Affairs

- Tax Audit and Quality Assurance Office.

Governing Board

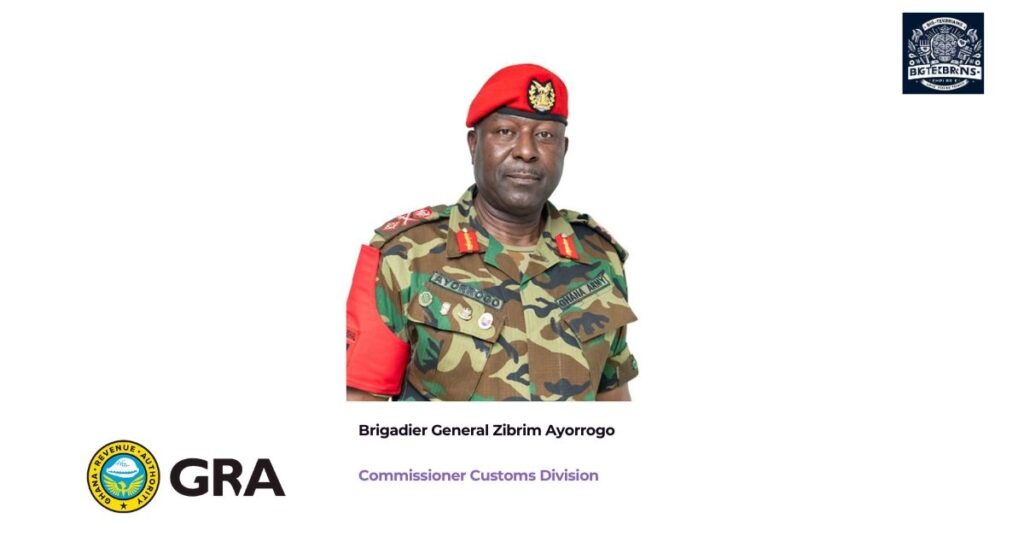

Hon. Joe Ghartey (MP) | Chairman

Chairman (Former Railways Minister and MP for Essikado-Ketan Constituency).

Ms. Julie Essiam | Member

Julie Essiam – Commissioner-General of the GRA.

Madam Susana Akomea | Member

Madam Susan Akomea – Presidential representative.

Hon. Okyere Baafi (MP) | Member

Mrs. Elsie Addo Awadzi | Member

Mr. Kwabena Abankwah Yeboah | Member

Mrs. Araba Bosomtwe | Member

Hon. Alhassan Abdakkah Iddi (MP) | Member

Dr. Alex Ampaabeng | Member

Divisions:

Domestic Tax Revenue Division (DTRD):

Handles income taxes, VAT, and excise duties. This includes The Audits, The Tax Force, etc.

Customs Division (CD):

Manages import/export duties and ensures trade compliance.

Support Services Division (SSD):

Provides IT, HR, legal, and public education services.

Tax Categories Administered

GRA collects taxes under two broad categories:

Direct Taxes

Income Tax:

Levied on individuals and businesses.

- Corporate Tax (25%)

- Pay-As-You-Earn (PAYE)

- Self-Employment Income Tax

Capital Gains Tax:

- Tax on profits from asset disposal

Gift Tax:

- Levied on taxable gifts above a certain threshold.

Rent Tax:

- A tax levied on income earned from renting out property (both residential and commercial).

- Applicable to individuals and companies receiving rent as part of their income.

Vehicle Income Tax (VIT):

- A presumptive tax imposed on commercial transport operators (e.g., taxi drivers, trotro operators, and bus drivers).

- It is assessed based on the type and capacity of the vehicle.

- Payment Method: Paid quarterly through the purchase of a tax stamp (Vehicle Income Tax sticker).

Property Tax:

- Collaborates with local authorities for collection.

Indirect Taxes:

Value Added Tax (VAT):

- Levied on goods and services (standard rate: 15%).

Excise Duty:

- Imposed on specific goods (e.g., alcoholic beverages, tobacco).

Communication Service Tax (CST):

- A tax on communication services (e.g., calls, data).

Import Duty and Levies:

- Charged on imported goods.

Customs Operations

The Customs Division ensures the security of Ghana’s borders and collects duties on imports and exports. Key responsibilities:

- Border patrol and smuggling prevention.

- Inspection and clearance of goods at entry points.

- Administration of free zones and bonded warehouses.

- Enforcement of international trade agreements and tariffs.

Revenue Collection Methods

GRA has modernized its collection systems:

Integrated Tax Application and Preparation System (ITAPS):

- Allows online filing and payment of taxes.

Ghana Customs Management System (GCMS):

- Facilitates customs operations and border tax collections.

Mobile Tax Payments:

- Taxpayers can pay taxes using mobile money platforms.

Taxpayer Identification Number (TIN):

- Required for tax transactions (now linked to Ghana Card).

Taxpayer Services

GRA offers services to make compliance easier:

Taxpayer Education:

Seminars, media campaigns, and community outreach to educate the public on tax obligations.

Customer Service Centers:

For inquiries and assistance with tax-related issues.

Self-Service Portals:

Online access to tax registration, filing, and payment.

Enforcement and Compliance

To ensure compliance, GRA employs:

Audits and Inspections:

- Regular checks on businesses and individuals to assess tax compliance.

Prosecution of Offenders:

- Legal action against tax evasion.

Tax Amnesty Programs:

- Periodic offers to encourage defaulters to settle taxes without penalties.

Collaboration with Other Institutions:

- Banks and financial institutions (to track taxable incomes).

- National Identification Authority (NIA) for identification.

- Registrar-General for business compliance.

National Development Contribution

The revenue collected by GRA funds:

- Public infrastructure (roads, schools, hospitals).

- Social programs (e.g., Free SHS, LEAP).

- Salaries of public servants.

- National debt servicing.

Regional and District Offices

GRA has offices in all regions and major districts, ensuring nationwide accessibility:

- Handles tax registration, filing, and complaints.

- Supports local industries and traders with compliance.

Modernization Efforts

To improve efficiency, GRA is adopting:

Automation and E-Governance:

Moving services online to reduce human errors and corruption.

Digital Integration:

Linking TIN to Ghana Card for seamless taxpayer identification.

Capacity Building:

Training staff on modern tax administration techniques.